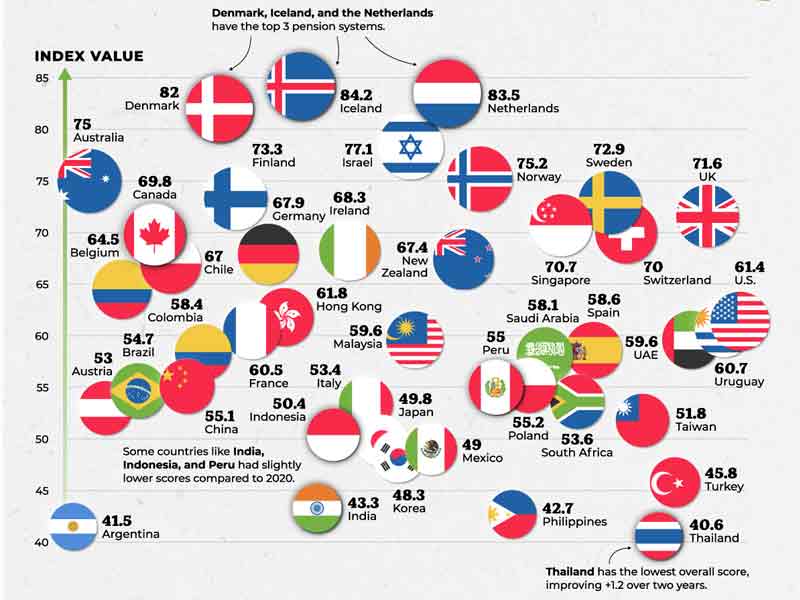

The Netherlands topped the list globally, followed by Iceland, Denmark, and Argentina, with Argentina coming in last.

The Netherlands’ retirement income scheme has once again taken first place according to the 15th annual Mercer CFA Institute Global Pension Index (MCGPI), which was just released. In the rating, Denmark and Iceland are ranked second and third, respectively.

With an overall index value of 85.0, the Netherlands led the field, closely followed by Iceland (83.5) and Denmark (81.3). It also mentioned that Argentina has the lowest index value (42.3).

According to the 15th annual Mercer CFA Institute Global Pension Index (MCGPI), India’s total index value increased to 45.9 from 44.5 in 2022, placing it 45th out of 47 retirement income systems examined. This rise was mostly attributable to improvements in the adequacy and sustainability sub-indices.

This year, 64 percent of the world’s population is covered by the Global Pension Index, which compares 47 retirement income systems worldwide. The Global Pension Index compares every retirement system to more than 50 indicators by calculating the weighted average of the sub-indices of integrity, sustainability, and sufficiency.

Three new retirement income systems (Botswana, Croatia, and Kazakhstan) are included in the 2023 Global Pension Index.

The research also showed that declining birth rates have over time put strain on a number of economies and pension systems, which has a negative impact on the sustainability scores of nations like Spain and Italy.

However, in the previous five years, a number of Asian systems—including those in Singapore, Japan, Korea, mainland China, and Singapore—have implemented reforms to raise their scores.

According to the study, the government has introduced these schemes as a part of the universal social security programme with the intention of helping the unorganised sector.

Also read: 6 Health Benefits of Cutting Out Sugar

Margaret Franklin, CFA, President and CEO of the CFA Institute, stated, “The average age of populations around the world continues to rise in many markets, mainly more mature markets.” “A new market dynamic brought about by inflation and rising interest rates presents serious obstacles for pension schemes. We observe ongoing disintegration in relation to globalisation as well. These are only a handful of the many intricate issues that pension funds deal with on a daily basis and which have a big effect on pensioners.

Individuals will more frequently have a bigger say in matters pertaining to their own retirement. Our job as investment professionals is to assist them in getting ready for it. This index is a vital annual reminder that many countries still have a ways to go before ensuring pension systems operate as efficiently as possible and that beneficiaries will have long-term financial security.”