Financial modeling is creating an abstract model representation of a legitimate financial situation, known as a financial model. It is a statistical model designed to represent a simpler version of the success of a financial asset or portfolio of trade, project, or other investment.

In other words, financial modeling is the interpretation of various aspects of a company’s activities. The endeavor aims to establish an abstract and conceptual representation of a real-world current financial situation, s referred to as financial modeling. It is a statistical model designed to represent a simpler model of the profitability of a financial asset or portfolio of a business, project, or other venture.

Financial modeling is the process of creating a model that represents a major financial circumstance. They are intended and deliberated to be used as decision-making tools. Business leaders can use financial models to assess the expenses and anticipate the returns of a proposed new project.

What is Financial Modelling?

Financial modeling is the process of creating a financial representation of a corporation. Using these financial models, financial analysts anticipate the company’s potential income and performance. To recreate corporate activities, analysts use a variety of projection theories and valuations given by financial modeling via these financial models. Once completed, financial models show a mathematical representation of business occurrences. The excel spreadsheet is the key tool used to develop the financial model.

The process through which a company creates a financial representation of some or all features of a company or securities. The model is often defined by running calculations and making recommendations based on the results. The model may also describe specific occurrences for the end-user and provide guidance on appropriate actions or alternatives.

Purpose of financial modeling

Financial models aid in steering the historical study of a firm, projecting the financial performance of a corporation, and are utilized in various fields.

These financial models are mostly utilized by financial analysts and are built for a variety of purposes. By developing financial models, financial modeling assists management in decision-making and the preparation of financial analyses.

The following are the goals of developing financial models:

- monetary value on a company

- Capital raising

- Expanding the company

- Making purchases

- Assets and business units may be sold or divested.

- Allocation of capital

- Budgeting and projections

The finest financial models include a set of fundamental assumptions. Sales growth, for example, is a frequently projected line item. The rise or decrease in gross in the most recent quarter compared to the prior quarter is used to calculate sales growth. These are the only two inputs required by financial models to compute sales growth.

Types of financial Modelling

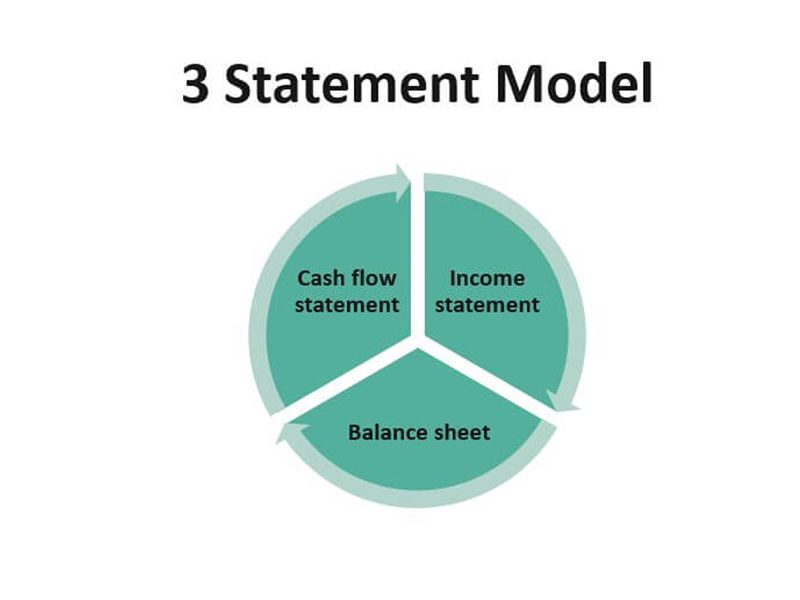

1. Model of Three Statements

The three-statement model is the most fundamental arrangement for financial modeling. As the name implies, the three statements, i.e., income statement, balance sheet, and cash flow in this model, are all dynamically referred to and linked with Excel formulas. The goal is to integrate all of the accounts such that a set of assumptions can drive changes in the entire model. It is critical to understand how to connect the three financial accounts, which necessitates a solid foundation of accounting, finance, and Excel abilities.

2. Discounted Cash Flow (DCF) Model

The DCF model extends the three-statement model by calculating the Present Net Value (NPV) of a company’s future cash flow. The DCF model includes the cash flows from the three-statement model, modifies them as needed, and then utilizes Excel’s XNPV tool to reduce them to the current time at the company’s Weighted Average Cost of Capital technique.

3. Merger Model (M&A)

The M&A model is a significantly more comprehensive and common model used to assess the pro forma accumulation of a merger or acquisition. It is usual to practice to employ a single tab model for each firm, with the consolidation of Company A + Company B = Merged Co. The degree of complexity might vary greatly. This concept is frequently utilized in investment banking and/or company growth.

4. Initial Public Offering (IPO) Model

Investment bankers and company’s strategic specialists also use Excel to create IPO models to value their companies before going public. These models use comparative market analysis with an estimate about how much investors are willing to pay for the company in the issue. An IPO model’s pricing incorporates “an IPO discount” to guarantee the trading activity well in the secondary market.

5. Leveraged Buyout (LBO)

A leveraged buyout deal often necessitates the modeling of complex loan schedules, a more advanced kind of financial modeling. Because of the various layers of funding, an LBO is frequently one of the most detailed and difficult financial models to develop, as it necessitates cash flow waterfalls. Outside of private equity and investment banking, these types of approaches are uncommon.

Also Read, Block Chain Technology? The future of Finances?

6. Sum of the Parts Model

This type of model is constructed by combining different DCF models. So, for example, you would add together (hence the term “Sum of the Parts”) the values of business units A, B, and C, minus liabilities D, to get the company’s Net Asset Value. Following that, any other components of the firm that would not be suited for a DCF analysis (for example, marketable securities that would be valued based on the market) are added to the business’s worth.

7. Model of Consolidation

This model incorporates many business units into a single model. Each business unit often has its own tab, with a merger tab that adds up the other business units. This is comparable to a Sum of the Parts exercise. Division A and Division B are combined to form a single, consolidated worksheet. Check out the free consolidation model template from CFI.

8. Budget Model

This is used to model finance for financial planning and analysis (FP&A) professionals to prepare the budget for the future year (s). Budget models are often based on monthly or quarterly numbers and strongly emphasize the income statement.

9. Forecasting Model

This kind is also used in financial planning and analysis (FP&A) to create a prediction compared to the budget model. Sometimes the budget and forecast models are incorporated into a single spreadsheet, and other times they are completely distinct.

10. Option Pricing Model

Binomial tree and Black-Scholes systems are the two most used forms of option pricing models. These models are based solely on complex algorithms rather than subjective criteria and, as such, are just a simple calculator built into Excel.