Even after expectations that prices were finally reaching a cap, hotel room rates are anticipated to increase by double digits in key cities from Boston to Mumbai, according to a new analysis.

According to the Hotel Monitor 2024 study from American Express Global Business Travel, which was released on Thursday, Buenos Aires wins this year with rates predicted to increase by 17% annually. With estimates based on factors like currently advertised prices, larger macroeconomic trends, hotel pipelines, and historical data, it analyzes how hotel costs are fluctuating in more than 80 cities across the world.

More than only a destination’s present level of traveler popularity is reflected in hotel pricing. The ongoing hyperinflation problem in Argentina, which in September hit its worst levels since 1991, is a major factor in the city’s rates. (It should be noted that the Amex research determines rate increases in local currency.) In other words, the growing costs in Buenos Aires are still likely to result in significant savings for the majority of foreign visitors.

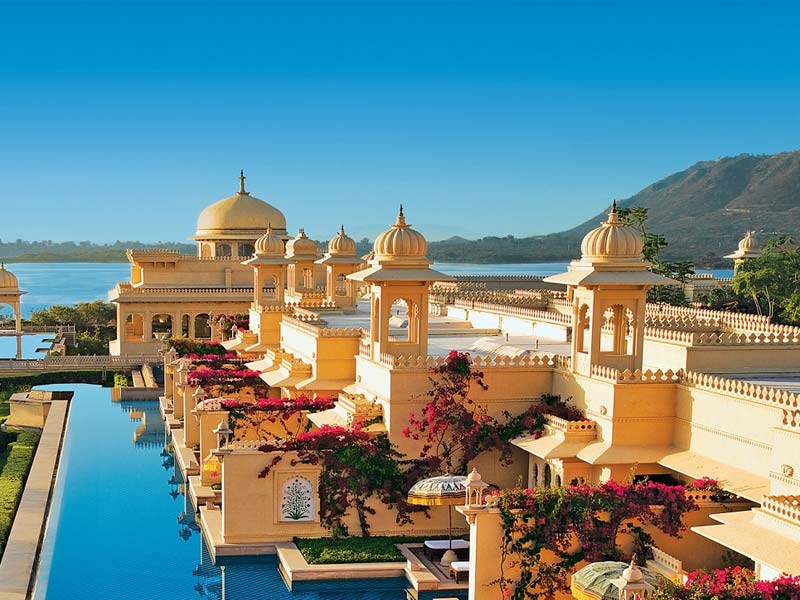

Second-place Mumbai’s story is simpler to follow. Its hotels are predicted to cost 15% more year than they do now, which is unquestionably a result of the country’s rapidly increasing affluence and the long-delayed post-pandemic travel rebound. Given that both of those variables are applicable throughout the entire nation, it is not surprising that three of the top 10 cities in the survey are in India.

Cities with booming tourism make up the remaining three cities in the top 10. Chicago, Paris, and Boston rank in the top 10 because of increases in corporate travel, while Cairo has profited from an audience that is primarily leisure-driven. Australasia, where no one city is expected to experience increases larger than 6.8%, is the area with the most mild rate increases.

In all 80 of the cities the research looked at, prices are anticipated to increase at least slightly.

Several macro issues are expected to continue to have an impact on hotel pricing on a global scale, according to David Reimer, executive vice president of global clients at Amex GBT. As a result of ongoing staffing issues, some hotels are being forced to reduce their inventory, which means they are purposefully leaving unsold rooms. By doing so, the rising operating costs are shared among fewer customers.

Also read: Singapore: Car ownership certificate now costs $106,000

Another problem is that there aren’t enough hotel rooms available to meet demand in any market.

Rates will increase in situations where demand is high but supply is not keeping up, according to Reimer. The opposite is also possible. In locations like Riyadh and New York City, which will add a significant number of new hotel rooms in the upcoming year, rates are anticipated to climb relatively minimally. Prices in those areas are expected to rise by 4.6% and 6.8%, respectively, according to the research. (The paper includes a disclaimer that warns current laws in New York City restricting short-term rentals may result in price increases not captured by Amex GBT’s data models.)

Here are the top 10 cities around the world where hotel prices are set to soar most dramatically—along with how much more you can expect to pay in local currency, compared to last year.

- Jakarta, Indonesia: 10.9%

- Boston, US: 11.3%

- Paris, France: 11%

- Delhi, India: 12%

- Chicago, US: 12.6%

- Bogotá, Colombia: 14.1%

- Chennai, India: 14.6

- Cairo, Egypt: 14.6%

- Mumbai, India: 15%

- Buenos Aires, Argentina: 17.5%