Finance is considered as the lifeblood of a firm, or business because finance is the only passkey that gives an approach to all sources of information for employees and management to decide for success. The success and future of the business largely depend on the systematic management of finances.

There are four main functional heads in a business firm which includes finance, marketing HR, IT. All of these areas are crucial for the proper functioning of the business. Finance is indeed considered a significant resource by every economic unit whether an individual or a private company. Without finance, no economic activity can be brought into existence. The work of a finance manager is significant for the healthy work environment of the business.

What is Business finance?

Business finance refers to the process of raising funds for proper working and to operate day-to-day activities. It is very critical to understand the company’s most significant instrument that helps the company to raise money i.e., debt or equity. It is worth understanding that raising funds is cheaper equity holders are the owners of the company in which they held security.

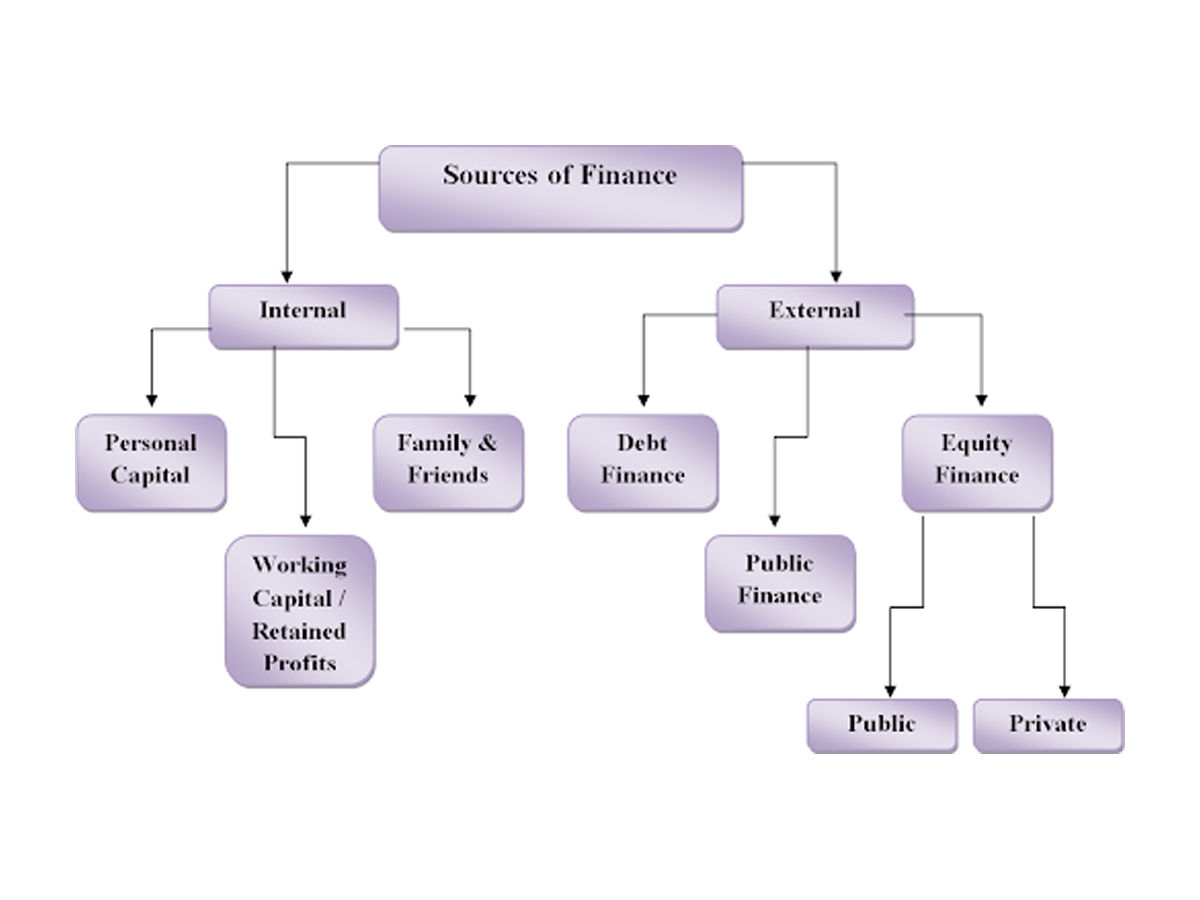

What are the sources of Business finance?

Loans from bank/financial institution

The loan from banks and financial institutional business is the most traditional source of raising money. If your business is old more than 3 years and your credit is good around 750. You can easily raise funds to carry on business.

Who it’s most appropriate to Businesses with a decent record as a consumer who looks for a single amount for venture yet aren’t in a rush.

pros: A bank credit is a dependable and believed wellspring of business money. Banks can loan out high amounts of cash over longer terms with sensible financing costs. A wellspring of subsidizing for making huge buys, or growing a business with a decent credit profile.

Cons: Bank advances haven’t been planned in light of the requirements of private companies. The terms they offer are regularly unbending, and the actual advances can be hard to acquire without a considerable history or significant guarantee. What’s more, the application cycle is frequently convoluted and tedious, including marketable strategies, lawful expenses.

Business credit card

The business charge card is perhaps the most helpful wellsprings of a business account. It is the most appropriate for occupied organizations that need earnest assets to do their everyday tasks purchasing new stock or hardware. It is an unstable credit office, so you are not stressed to lose any resource. Notwithstanding, on the off chance that you pick a business charge card, you ought to be mindful so as not to surpass your acknowledge limit as it would influence your credit score.

Pros: A Mastercard is a sensibly brisk and advantageous method of sourcing financing when you need it most. It’s not especially difficult to meet all requirements for (there are choices to coordinate with most credit profiles), in addition to it’s unstable so none of your resources will be in danger. On the off chance that you reimburse in full every month, the expense can be exceptionally low.

Cons: It can be an unsafe method to put resources into your business for a couple of reasons. Right off the bat, a Mastercard can be costly as interest is typically high and can accumulate rapidly if the equilibrium isn’t paid on time each month. A Visa is likewise commonly more qualified to spending more modest sums, so in case you’re needing a mass total, there are better choices accessible, for example, a Business Cash Advance or bank credit.

Know that: Going over the limit or potentially late installments can cost a ton and add to a negative credit score which will antagonistically influence the capacity to get to different types of business accounts.

Business cash advances

It is a transient wellspring of business money for organizations that take card installments. With business loans, you can receive reserves dependent on your card deals, and consequently, you need to pay a concurred level of your client card takings. This implies that you pay just when your clients pay you.

Who it’s most appropriate to Seasonal organizations who experience highs and lows consistently or the individuals who need transient financing that is easy to reimburse. Likewise, the individuals who haven’t got an immaculate FICO score yet can utilize their card takings as security to get financing to develop their business.

pros: There is one fixed add-up to pay that never shows signs of change so there is conviction while planning. Reimbursements are adaptable and dependent on repaying a concurred level of client card takings (money takings are unaffected). If the business is blasting you’ll take care of it quicker, and if you’re encountering somewhat of a break, you’ll have more opportunity to take care of – all at a similar rate. While reimbursing a Business Cash Advance, you’ll never be charged any late punishments or covered up expenses. Additionally, the application interaction is ordinarily straightforward and can be finished online in less than 5 minutes

Cons: Your business should get a base sum in client card installments each month to be qualified for a Business Cash Advance.

Crowdfunding

This monetary arrangement is turning into a mainstream decision for new organizations or new businesses to get reserves. On the off chance that you have an energizing business thought that can change into an example of overcoming adversity, at that point crowdfunding can be an able decision to get reserves. All you should do is join a crowdfunding site, share your project and elevate it well to support the gift. Probably the greatest benefit of this monetary arrangement is that you can gain admittance to reserves regardless of whether you have a low FICO rating. Be that as it may, this type of business account can help you just for a greater venture and not for the business’ ordinary costs.

pros: A decent financial record isn’t a prerequisite for this subsidizing technique, so in case you’re battling to apply for a new line of credit because of helpless credit, this is an ideal other option. As a little something extra, if your mission is effective you’ll as of now have produced buzz encompassing your task, making it bound to succeed!

Cons: There’s no assurance you will raise every one of the subsidies you’re requesting. Furthermore, you’ll need to put resources into recounting your story, as except if your mission circulates the web, procuring those assets is probably going to be a lethargic interaction.

Know that: Crowdfunding won’t work for little, regular costs like buying stock or gear – it’s more appropriate for bigger tasks or item dispatches.

Invoice Factoring

invoice factoring is a sort of indebted person account where a business offers its open solicitations to a considering organization for a decreased sum that is accessible right away. You’ll be progressed reserves at whatever point your business gives new solicitations and the figuring organization will get an installment of that receipt.

Who it’s most appropriate to Businesses who have given solicitations and in are need of subsidizing for regular costs to keep income consistent.

pros: Invoice calculating is an adaptable getting arrangement. The sum that a business can acquire increments as deals increment. What’s more, the advance is unstable, which means your property will not at any point be in danger, similar to it very well maybe with bank credit. The other advantage is the re-appropriating of the activities behind gathering installment from your providers as the calculating organization requires that exertion and the danger of them not paying on schedule or by any means.

Cons: Factoring can be unsafe. The components legitimately own your obligations, implying that the solicitations you raise consider their resources.