The International Monetary Fund (IMF) increased its GDP growth prediction for India for 2023-24 to 6.1 percent from 5.9 percent due to the January-March growth outlier.

The multilateral agency said on July 25 in a revision to its World Economic Outlook (WEO) report that economic expansion in India is projected at 6.1 percent in 2023, a 0.2 percentage point increase from the April projection, displaying momentum from stronger-than-expected growth in the final quarter of 2022 (financial year 2022-23) as an outcome of stronger domestic investment.

The statistics ministry revised its forecast for growth in 2022–23 by 20 basis points to 7.2 percent after data released on May 31 revealed that India’s GDP growth in the initial quarter of 2023 jumped to 6.1 percent, above all expectations.

A Tenth Of A Percentage Point Is Called A Basis Point

The IMF’s upward revision of India’s GDP prediction on July 25 reverses its April judgment, when it trimmed its projection for 2023-24 by 20 basis points to 5.9 percent.

Despite the course correction, the IMF is not as optimistic about India as the government or the Reserve Bank of India (RBI), both of which forecast 6.5 percent GDP growth in 2023-24.

As a result, the IMF’s expectations are more in line with those of some private sector economists, who see India’s growth slowing sharply to less than 6% this year due to weakening global growth prospects as a result of central banks around the world rapidly tightening monetary policy to combat high inflation.

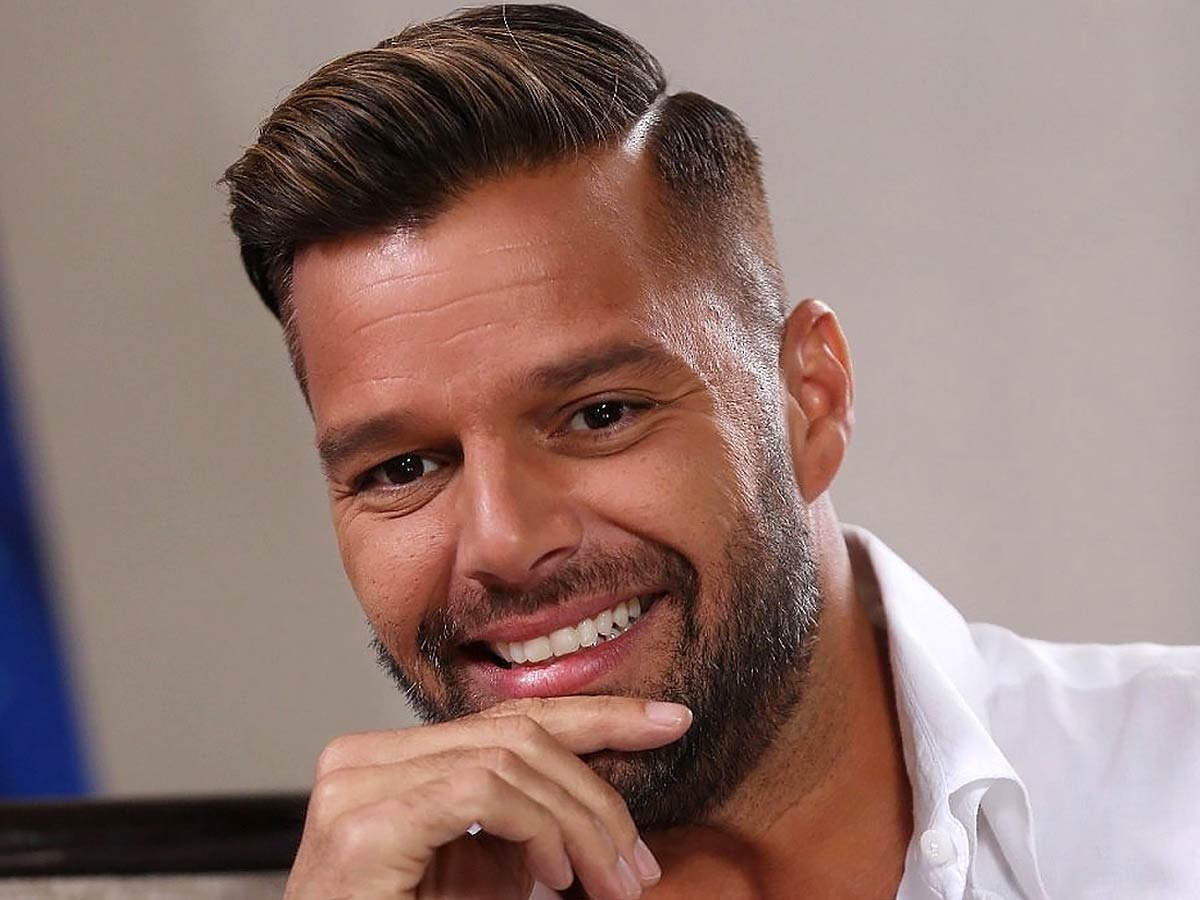

The new World Bank President, Ajay Banga, declared earlier this month during a conference of G20 Finance Ministers and Central Bank Governors in Gandhinagar that he is “more optimistic about India today as a whole than I have been for a long time.”

The IMF has not changed its prediction for next year, predicting that India’s GDP will increase by 6.3 percent in 2024-25.

Global Forecasts

The IMF’s upward revision of India’s growth prediction is consistent with its revised outlook for the world economy, which it now expects to rise by 3% in 2023, up from 2.8 percent in April.

The IMF issued a warning, however, that the impact of interest rate increases announced by central banks to combat inflation has not abated.

Inflation is still high and is decreasing the purchasing power of households. As a result of central banks’ tightening of policy in response to inflation, borrowing has become more expensive, which has limited economic activity.

Although there are no longer any immediate worries about the state of the banking sector, high-interest rates are still having an impact on the financial system, and banks in advanced economies have dramatically tightened lending rules, which has reduced the availability of credit, according to the IMF.

While the IMF increased its global growth projection for 2023, it kept its 2024 forecast at 3 percent, indicating that it anticipates a short-term plateau in global growth.

The IMF stated that while the balance of risks to global GDP remains skewed downward, negative risks have decreased (since April), citing the conclusion of the US debt ceiling dispute and steps taken to address issues in the US and European banking sectors.

Also, Read India’s prohibition on rice exports causes panic purchasing in the US

The IMF has increased its prediction for the US by 20 basis points to 1.8 percent in 2023, predicting that it will grow more quickly than originally anticipated, similar to the global economy. The prediction for 2024 was, however, reduced by 10 basis points to 1 percent.

For 2023 and 2024, the Euro area’s rates increased by 10 basis points, to 0.9 percent and 1.5 percent, respectively. The 5.2 percent and 4.5 percent growth predictions for China for 2023 and 2024, respectively, remained unchanged. The IMF noted a change in the mix of Chinese growth, nevertheless.

The agency expects global headline inflation to fall from 8.7 percent in 2022 to 6.8 percent in 2023 and 5.2 percent in 2024, with core inflation seen declining more gradually from 6.5 percent in 2022 to 6 percent in 2023 and 4.7 percent in 2024.

It (core inflation) is proving to be more persistent than expected, primarily in advanced economies, where predictions for 2023 and 2024 have been adjusted upward by 0.3 percentage points and 0.4 percentage points, respectively, compared to the April 2023 WEO.

The IMF revised global core inflation down by 0.2 percentage points in 2023, citing lower-than-expected overall inflation in China, and increased by 0.4 percentage points in 2024.

“While investment has slowed due to the nation’s ongoing real estate crisis, consumption growth has largely kept pace with April 2023 WEO predictions. Stronger-than-anticipated net exports have somewhat offset the investment shortfall, though the IMF notes that as the global economy declines, their contribution will be less and less.

Inflation Concerns

The IMF reiterated recent comments made by its managing director Kristalina Georgieva when it noted on July 25 that maintaining prolonged deflation remains the top worry for most economies.

The IMF emphasized that central banks should continue to make unambiguous signals about their commitment to lowering inflation in economies with high and prolonged core inflation.

IMF ‘Encourages’ India To Lift Export Limitations

Washington, July 26 (PTI) The International Monetary Fund said it would “encourage” India to lift export restrictions on a specific type of rice because doing so would have an effect on global inflation.

The Indian government banned non-basmati white rice exports on July 20 to improve domestic supplies and manage retail prices during the upcoming holiday season. About 25% of all the rice that is exported from the nation is of this variety.

The majority of rice exported, basmati and par-boiled non-basmati rice, would continue to be subject to the same export regulations, the food ministry announced.