SoftBank Group Corp. will bring a group of Indian company founders to Silicon Valley next month for an artificial intelligence tour, as the Japanese investor ramps up attempts to inject the technology into its portfolio companies.

According to Sumer Juneja, a managing partner overseeing SoftBank’s Vision Fund investments in Europe, the Middle East, Africa, and India, the investor is assisting portfolio companies in adopting AI and has been setting up meetings for the founders it backs with the leading players in the field.

SoftBank expects to take several of its 20 India company founders on the tour, he said, without naming specific individuals. In the country, it owns Oyo Hotels, Ola, a ride-hailing service, and Swiggy, a delivery company.

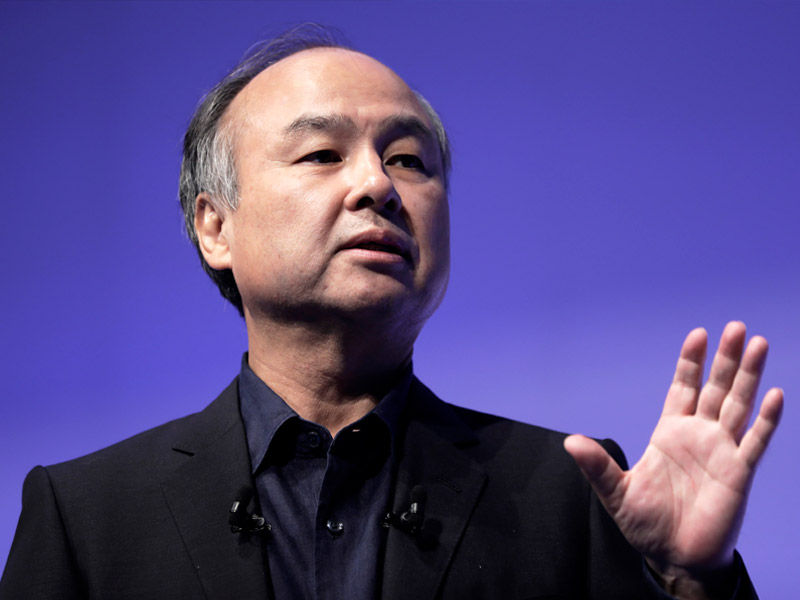

SoftBank, helmed by Masayoshi Son, resumed startup investments in the June quarter following a virtual halt as investors turned against money-losing businesses. The Japanese conglomerate has amassed more than $40 billion in cash and is in the process of taking chip maker Arm Holdings Ltd. public in a deal that will raise further funds.

We don’t want to fund a business that misses the AI revolution and then fades away three years later, Juneja said. “Having a sophisticated tech team as well as being in the right industry where AI could be used to make the business model more effective are must-haves for us to write new cheques.”

Due to the international surge in the popularity of products like ChatGPT, investors are rushing to support AI firms. If they don’t immediately implement AI use cases, companies in various industries, including software-as-a-service, will go out of business, claims Juneja. The best way to use AI now, meanwhile, is the largest problem.

“If you are too early or too late to the AI party, it won’t have an effect on your revenue. We are assisting in making sure the transition is successful, he said.

Also, Read CEO of CEN: vegetable prices to drop starting in September

After founding the Vision Fund in 2017, Son spent more than $140 billion in companies, promoting the promise of cutting-edge technology like artificial intelligence. However, the value of several of these investments has collapsed, notably the office-sharing firm WeWork Inc.