Nirmala Sitharaman, the union finance minister, announced five significant modifications to personal income tax on Wednesday, which will be a big relief to middle-class and salaried individuals. The country’s “hard-working middle class,” according to Sitharaman, who presented the Union Budget for FY 2023–2024, will principally benefit from the personal income tax measures. According to Sitharaman, the new income tax system will now be the default tax system.

In the budget for 2023, Sitharaman declared that the new income tax system would henceforth be the default one. The prior tax structure will still be available to citizens if they so want.

The personal income tax rebate was the subject of the first recommendation. Both the old and new tax systems exempt anyone with income under Rs. 5 lacks from paying any income tax. Sitharaman suggested increasing this refund cap in the new tax system to $7 lakh. Therefore, she explained, “those in the new tax regime with income up to 7 lacks will not have to pay any tax.”

In 2020, Sitharaman unveiled a new system of personal income taxation with six income tax brackets beginning at 2.5 lacks. Currently, she is in favour of a five-slab system with a three-lakh rupee tax exemption level.

She suggested incorporating the standard deduction’s advantages into the new tax code. “Any salaried individual with a salary of 15.5 lakh rupees or more will therefore stand to benefit by 52,500 rupees,” the minister claimed. The third plan was for the salaried class and pensioners, especially family pensioners.

Sitharaman suggested reducing the maximum surcharge rate in the new tax system from 37% to 25%. She claimed that the anticipated change would result in a 39% top tax rate. Her fourth option for the personal income tax was the highest tax rate, which is currently 42.74 percent.

The cap on the tax exemption on leave encashment after retirement for paid non-government workers was the fifth and final significant pronouncement regarding personal income tax. The 3 lakh ceiling was last set in 2002 when Atal Bihari Vajpayee was the prime minister and the highest monthly basic pay was 30,000. Sitharman suggested raising this cap to 25 lacks to keep up with increases in government wages.

The fact that the fiscal deficit has been contained within reasonable bounds inspires some confidence. That’s when so many nations, both richer and poorer (especially those nearby), have destroyed their economies over three pandemic years. This government followed its advice and did not pay attention to well-intentioned but anxious economists. The result of maintaining its composure is that India’s economy is currently in a somewhat better position.

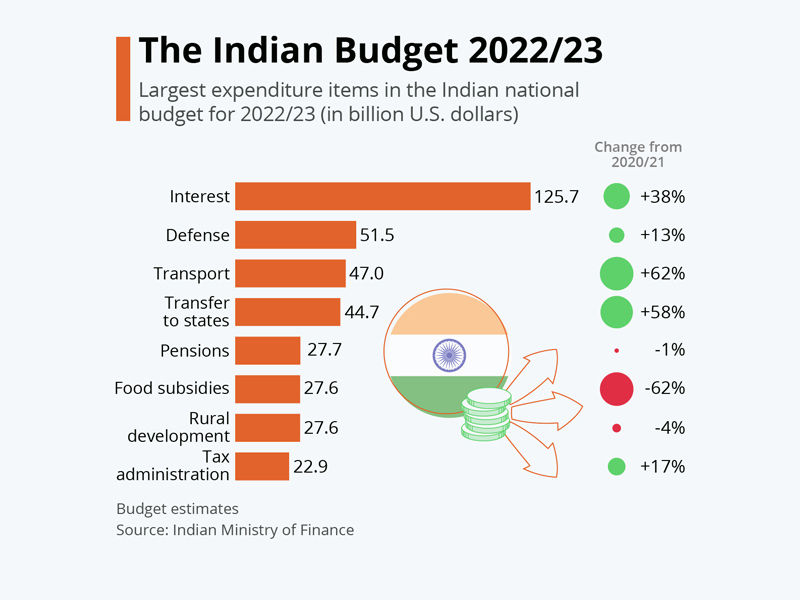

Maintaining nearly constant defence spending is another sign of confidence. The current One Rank, One Pension (OROP) hikes and arrear payments inevitably increased pension expenditures. However, capital outlay (or purchases in common parlance) is only up Rs 12,000 crore or 8%, lagging even the nominal GDP growth of 10.5%. The Modi administration is confident that there won’t be hostilities and will likely wait for the Agnipath programme to take effect when the Army’s manpower and wage bill start to drop by the end of the following year.

Also read: Will India overtake Japan as the 3rd largest economy by 2029?

The traditional Indian political economic strategy is to appear to be harming the rich to placate the poor. The Modi administration reduced corporate taxes two years ago, drawing widespread criticism. A government run by the Ambanis and Adanis for the wealthy.

They’ve done something comparable, albeit on a smaller scale, for the wealthiest people, which demonstrates two things. One thing is for certain: They believe they are so far ahead of schedule for 2024 that they can afford to take these risks.

The second is likewise accompanied by some optimism on our part: that the reduction in personal tax rates would also increase total tax revenues. This is precisely what has happened with corporation taxation, as this budget also confirms.