According to the incoming president of the World Bank, India has a chance to profit from multinational corporations’ initiatives to construct plants outside of China as they look to diversify their supply chains.

His remarks come after recent investment announcements by American companies, like chipmaker Micron Technology, in India, and at a time when relations between the two countries are becoming more tense. The US is looking for a potent counterweight to China in Asia.

Many businesses have recently embraced a “China Plus One” strategy to establish additional production facilities outside the People’s Republic.

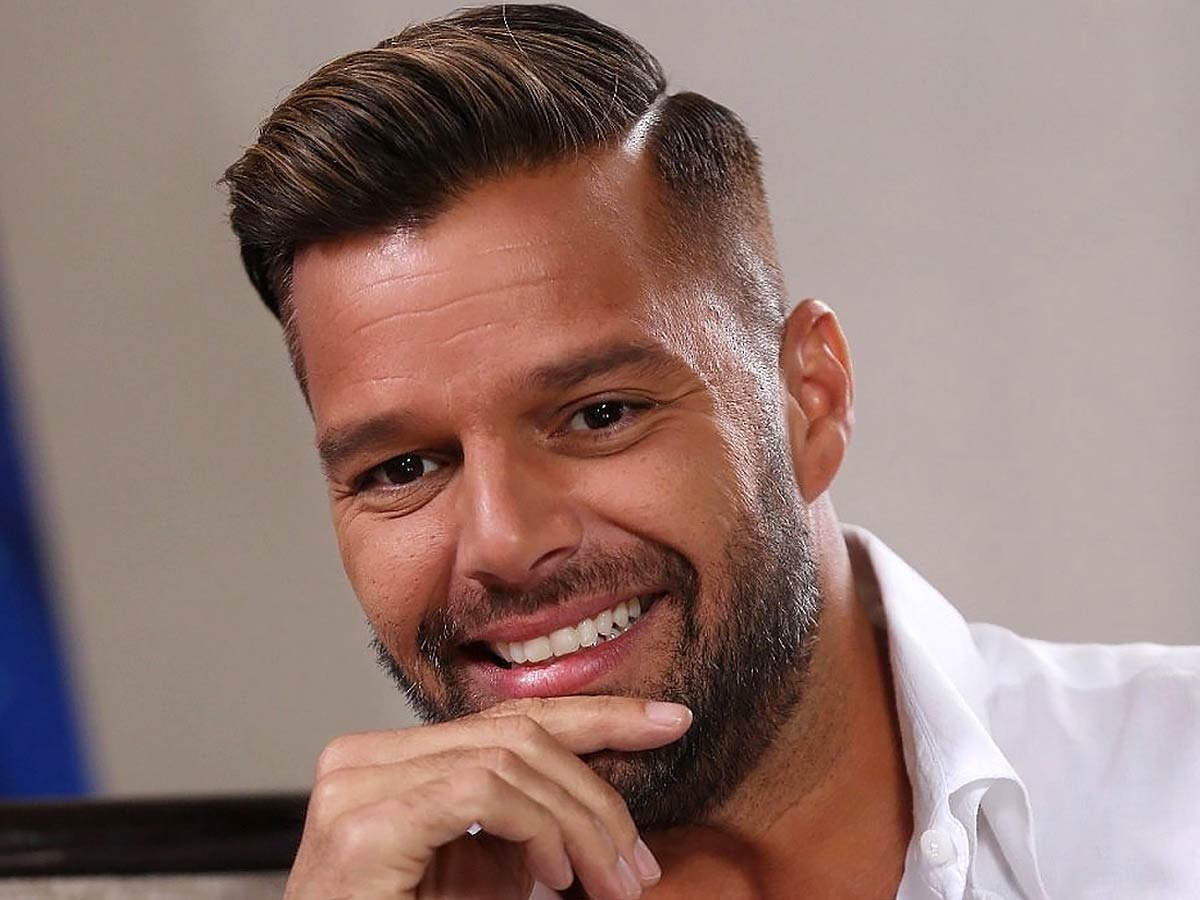

According to Ajay Banga, the former CEO of Mastercard who was appointed head of the World Bank last month, India has between three and five years to take advantage of this chance to draw in investment.

Also, Read Meta To Be Fined $ 100,000 Per Day By Norway for Violations

“I believe that India today has a chance to profit from the ‘China plus one opportunity. During his inaugural trip to the nation, Banga warned the media in New Delhi that this opportunity wouldn’t last for ten years.

The first state visit by Indian Prime Minister Narendra Modi to the United States took place last month, at the same time as a flurry of investment announcements by American businesses in India.

According to Banga, domestic consumption has insulated India’s economy from the global slump.

He also spoke with India’s Finance Minister Nirmala Sitharaman about the G20 bloc, which India is currently presiding over.

Following the meeting, he stated, “There is more danger on the negative in terms of a slowdown in the global economy in the early part of next year.

The head of the World Bank also urged private financial contributions to support international efforts to finance renewable energy.

According to the lender, a shift to green energy in poor countries by 2030 will cost $1 trillion and contribute to the achievement of net-zero goals.

We will in fact need a variety of forms of concessional finance. To take first risk positions or to make it possible for the blended financing to materialize, we will also need various forms of multilateral bank capital, government capital, and philanthropic money, Banga added.