Your CIBIL score, which is a major part of your CIBIL report, is one of the crucial elements in deciding whether or not your credit application will be approved. If you need a personal loan or a house loan right away, a low CIBIL score may be a huge obstacle. But don’t worry, your CIBIL score is only a number, and it may be steadily raised by taking into account the later-discussed actions. The top 10 methods listed below are all you need to perform to raise your CIBIL score.

The Top 7 Ways to Raise Your CIBIL Score

You may increase your CIBIL score and easily obtain credit by diligently following these easy steps:

-

Establish standing reminders or instructions to repay on time.

Making a severe error and failing to repay your ongoing debt might harm your CIBIL score. When it comes to paying the credit card or loan EMIs on time, you must be prompt. In addition to paying penalties if the EMIs are skipped or delayed, your credit score will also suffer. Setting reminders to pay on time and posting standing instructions or orders to your bank account, where any fixed payments are made, are the two greatest approaches to prevent any payment delays.

-

Review your CIBIL report for errors.

Even though you may have a clean credit history, there might still be several undiscovered inaccuracies affecting your credit score. Errors may include mismatched overdue or paid-off amounts, incompatible account data, duplicate accounts, erroneous Days Past Due or Collateral details, incorrect personal information, etc.

For instance, even though you have fully paid off your loan and closed it from your end, it is still shown as current due to an administrative mistake. You must also keep an eye out for other mistakes and odd behavior. Correct these mistakes by filing a CIBIL dispute resolution online at the company’s official website, and watch as your CIBIL score gradually rises.

-

Continue to have a balanced credit mix.

Always keep a good balance between unsecured loans like credit cards and personal loans and secured loans like mortgages and vehicle loans. Lenders favor borrowers with more secured loans since there is security or collateral attached, which reduces the risk to banks for the borrower. To keep a balance between secured and unsecured loans if you have many unsecured loans, try prepaying them.

-

Clear all Credit Cards Dues

Any lender seeks good and positive financial behavior and clearing off all your credit card dues signifies this behavior. Strategically plan to clear your credit card balances before the due date and increase your credit score. Make sure there is no numeric attached to the Days Past Due (DPD) section in your CIBIL report.

-

Pay off all credit card debt

Clearing all of your credit card debt demonstrates the kind of activity that lenders look for in borrowers. Plan to pay off your credit card amounts in full before the due date to raise your credit score. Check your CIBIL report to make sure the Days Past Due (DPD) section does not have any numbers associated.

-

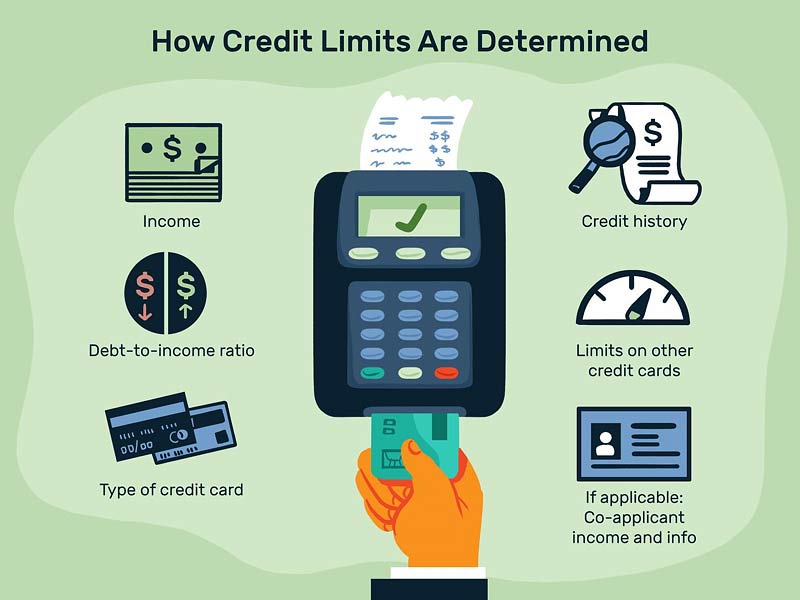

Refrain from serving as a co-applicant or guarantor.

Avoid holding joint accounts or signing on as a loan guarantor because any default by the other party would affect your CIBIL score. The CIBIL score of the borrower as well as the co-applicant or guarantor may significantly decline if the borrower fails on loan repayment, skips, or delays the repayment of loan EMIs.

-

Apply for a secure credit card

Your CIBIL score will increase if you obtain a secured card from a reputable bank, such as HDFC Bank, ICICI Bank, Axis Bank, SBI, etc., in exchange for a set deposit and return the remaining balance by the due date. Paisabazaar also provides one such card, the Step-UP Card.

Also read: Shopping: 11 Best Thrift Markets Of India For You

-

Don’t submit several loan applications quickly

To avoid having your credit score decline, paying off the present loan before applying for a new one is a good idea. Multiple credit applications demonstrate your credit-hungry habit, and the lender will likely presume you don’t have the money to cover all of them. The bank can ultimately reject your credit application as a result of this. Therefore, it is suggested to only take out one loan at a time and make on-time payments to raise credit scores.