Economics has an impact on our lives in both visible and subtle ways. Individually, economics shapes many of the decisions we face regarding job, leisure, spending, and how much to save. Macroeconomic factors, such as inflation, interest rates, and economic development, can have an impact on our lives.

Why is Economics so important?

- The opportunity costs we confront when determining what to buy – how we spend our time

- How can we maximize our economic utility while avoiding behavioural bias?

- How the macroeconomic factors — inflation, economic growth, and employment prospects – impact our level of living.

- Individual markets, such as the property market, can have an impact on our level of life.

Understanding concerns such as externalities. We may not enjoy paying the gasoline tax, but when we see how it helps to minimise pollution and congestion and how the tax income is utilised to subsidise public transportation, we get a different picture.

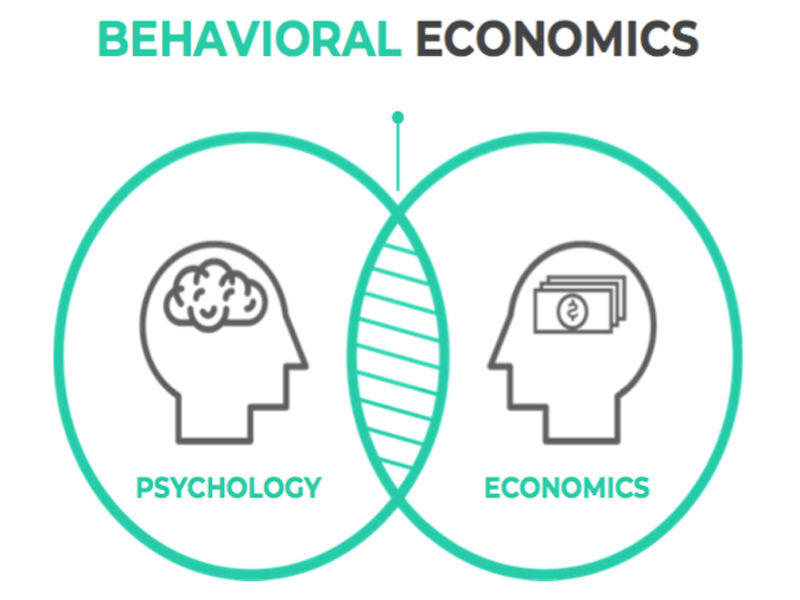

Bias in behavioral economics

The rationality of man is assumed in traditional economic theory. However, research in behavioural economics reveals that people are susceptible to prejudice and illogical behaviour. For example, we may be prone to a present bias in which we overestimate pleasure in the short term while ignoring long-term consequences. For example, consuming deplorable things such as alcohol or failing to save adequately for retirement.

The realisation of current bias implies that we make decisions that our future selves would not make. We can make better judgments and increase our long-term wellbeing if we become aware of these biases and illogical behaviour.

Economic alternatives–opportunity cost

We are frequently confronted with options. It might be a question of time. For instance, on the weekend:

We may work in a cafe for 8 hours at the minimum wage of £7.83.

- Alternatively, we may spend 8 hours studying for our A-Levels.

- Alternatively, we could spend 8 hours of leisure time (sleeping in, Facebook e.t.c.)

Each option has a cost in terms of opportunity. We don’t have time to study because we earn 8*£7.83 = £62.64 per hour. This may result in weaker exam outcomes, which may result in a decreased future earning potential. Choosing to maximise our income in the short term (earning £62 a day) may reduce our lifetime earnings and could be a poor decision – unless working in a cafe doesn’t affect our future earnings. We may feel job experience is way more useful than to read an essay on allocative efficiency.

The issue is that while deciding whether to study, work, or pursue leisure activities, we may neglect or ignore long-term consequences. Making the decision to spend all of our leisure time earning £62 is something we may come to regret later in life. According to economists, education is a merit good, which means that individuals may overestimate the benefits of learning. Education underconsumption is one example of market failure.

Consideration of opportunity cost can assist us in making better judgments. We may take the most gratifying or simplest course of action if we act on instinct, but the best option in the short term may not be the greatest one in the long run.

The macroeconomy’s importance in our daily lives

When making judgments, we don’t always look to leading economic indicators first. However, expectations of the economy’s prospects might impact certain actions. Those who are knowledgeable of the present economic situation, for example, may be aware of the severity of the recession, which makes a time of low interest rates more possible. This implies that if you could acquire a mortgage, your mortgage payments would be lower, but saving would provide a low return.

Also Read, Underground Economy: How Black Market Affects Indian Economy?

The dismal status of the economy and high unemployment rate, on the other hand, may motivate students to stay and study. Because young unemployment is so high right now, it makes more sense to spend three years acquiring a degree rather than jumping right into the labour market.

The only difficulty is that many other pupils believe the same thing. As a result, competition for university admissions is heating up.

How to Survive an Inflationary Period

Hyperinflation

- Children play with money that has become worthless due to inflation.

- What if we were to live in an era of excessive inflation? How would this effect our economic well-being?

Unless we can obtain an interest rate greater than the rate of inflation, the actual worth of our savings will diminish. During periods of high inflation, it may be prudent to invest in index-linked savings–savings accounts and bonds that pay an interest rate that is proportional to the rate of inflation. If we are unable to acquire a reasonable interest rate, we have the alternative of investing in commodities or assets that can safeguard their value better than traditional savings accounts.

How would higher interest rates affect us?

If interest rates rise, the cost of mortgage payments, as well as interest on loans and credit cards, will rise. It might be difficult for those who are overextended on credit. Higher interest rates can also cause the economy to stall and raise the chance of unemployment.

The affordability of mortgages In the late 1980s, high interest rates caused mortgage payments to consume more than half of a household’s take-home earnings.

We can see how we interact with economics in our daily lives without even knowing.

Economic constraints

Last but not least, is economics overvalued? Do we, as a society, place too much emphasis on maximising money, profit, and GDP? In some ways, orthodox economics pushes us to perceive life through the lens of money. However this may drive us to overlook other essential matters, such as spiritual awareness, environmental care, concern for others, and achieving the proper work/life balance.