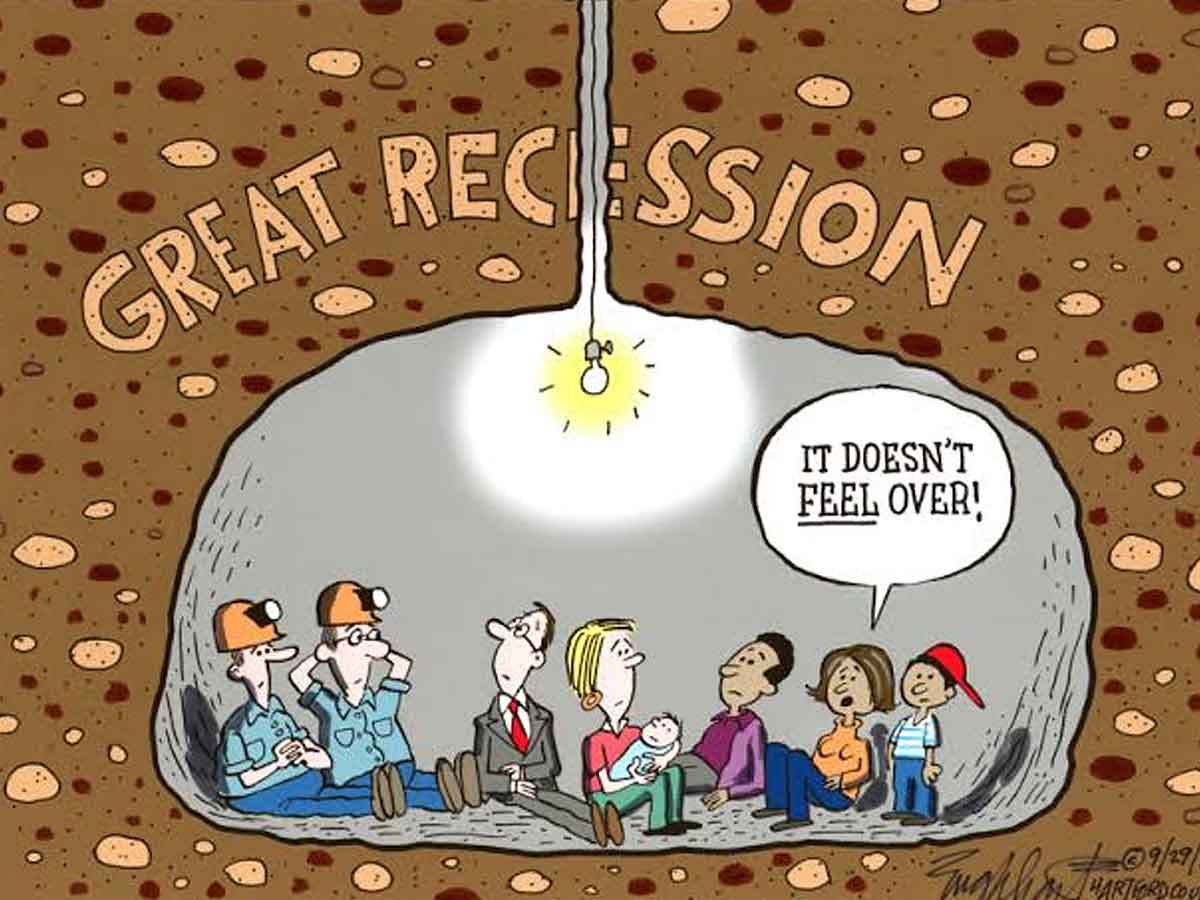

Wherever you will look these days there is proof of the economic fall-out due to the coronavirus pandemic. Businessmen are suffering huge losses. government main source of income in India like railways is not operational fully because income was mainly from local trains tourism and airlines industry are still facing huge losses a. Unemployment and poverty rates are climbing. Businesses are shutting down. If you will see all these factors now might not indicate a recession. Add them together, and it’s starting to look like a recession is in progress or approaching nearby. Recession is part of the business cycle and in long term can be recovered

What is a Recession?

It is a period when there is a general decline or fall in economic activities. In other words, decrease in income employment, and output level or decrease in the gross domestic product of a country in two or more consecutive quarters of the year, and negative growth of the total value that country produces

How long does Recession will last in this pandemic?

The first 2 quarters of the financial year 2020 saw GDP falling sharply. On April 20-30 million people lost their job as per statistics. It’s a global pandemic making It the most Recession on record. Many of the businesses were shut down permanently. In the 3rd quarter, relaxation was provided by the government. Economy growth of the country starts recovering at a very low rate. In India, its expected as per domestic rating agency Icra Ratings expects a recession in the country would end in the fourth quarter of the current fiscal year and it limits the contraction in GDP to 7.8% in F.Y 2021. In the second quarter, GDP contracted 7.5% as again the downfall of 23.9% in April June quarter 2020. The recovery of economic growth is at a very low pace.

What happens in a Recession?

Typically, unemployment, poverty rises and hiring slows down. Organizations may report mass lay-offs, as has just occurred at certain organizations that have been hit hard by the closures in the wake of the Covid flare-up. Consumer spending generally falls. The purchasing power of people falls. Stocks and different resources can lose an incentive as financial backers alarm sell, or sell speculations for required money, and the interest for specific resources decreases. Manufacturing and services decline. prices of real estate decline because people are left with very little purchasing power. as the economy starts to recover these trends will shift in future

Also Read, 5 Industries That Are Reeling Under Pressure Due To Global Economic…

5 facts that will prepare you for the Recession

Get ahead of any debt or loan

If you are out of work or don’t have any job right now, falling shortage of funds, or had some kind of debt. Now it’s time to make repayment of advances. But stop making any extra payments. Make sure you cover necessities of life (food, clothes, shelter, and transportation). If you have any kind of secured job but you are paid less now continue to work there control your expenditures and focus more on savings.

Refine and work on your skillsets

In this pandemic, unemployment is rising. To secure your job by improving your skillsets. so that no one has the power to question your work. Grab other opportunities side by side. as rising unemployment doesn’t that companies had stopped their hiring process. Try to resist changes, and try to work out of your comfort zone.

Cut down your expenditures

Lower down your expenses. Try to avoid wasteful expenses as this pandemic situation is uncertain. Start recording and analyzing your daily transactions keep a budget with you. It will help to control your expenditure and stop making impulsive purchases.

Start saving and build an emergency fund

After limiting your expenditures start saving for future uses as this COVID-19 situation is uncertain. There are possibilities of developing health-related issues as corona strain is very dangerous. You must ensure necessary savings for future uses. If uncertainty arises due to health, business shut down, and job security. You must have a minimal amount of savings to overcome this situation. Start preparing emergency funds for the future.

Plan your investments carefully

There is an immediate turning point in the market due to the global pandemic. So plan your investments carefully. Due to economic crises, there will be a lot of fake humor about stocks. Analyze the market carefully don’t trust humor take wise decisions accordingly. Plan your investment accordingly that you earn a safe and secure amount of return on it.