Blogs, financial news sites, Wikipedia, journals – there’s a long-range of tools out there to read about personal finance. And while facts will teach, it doesn’t always encourage you.

One of the best methods to get a grip on the subject, or to begin to understand how a complex structure operates, is to watch other people go through the process of learning about it. Understanding their motives and feelings, the errors they make, and the realities they recognize, will place a human spin on the most mundane of subjects – and motivate you to do the same.

Movies are not solely for sheer amusement. They offer useful lessons that can be extended to your personal or professional life, including tactics that can help you better handle your money.

Here are some top movies to understand finances.

- Office Space (1999)

Not every film that provides financial life lessons is a downer. “Office Space” is a new classic about a guy who hates his work. Do you know someone like that? The tribulations of Initech, where the lead character Peter Gibbons (Ron Livingston) lives, are now being baked into pop culture – TPS reports, stolen staples, flair, and printers that need to be pulled down and swept to smithereens.

All shifts as our hero are hypnotized, but he never comes out of the spell. Suddenly, life is lovely. He’s got no trouble turning up late, being frank with his bosses, and asking a sweet waitress out after a year of smashing.

What’s your lesson? There’s a lot of them. First of all, your work can be more than just a paycheck. All should aim to get some satisfaction out of their chosen career. Second, a constructive approach to adversity is a good thing, not a responsibility. If you face problems at work, tackle them with your face-to-face game and an optimistic vision for their resolution.

Yeah, we can’t all get our excellent work, but even if you’re trapped in a corporate hellhole, take a lesson from Gibbons’ playbook and be cheerful and open and honest. Who knows, the managers may be worth more than you thought.

2. The pursuit of Happyness (2006)

Entrepreneurship can also be a great road to success, and the depiction of Chris Gardner by Will Smith is a prime example. In the “Pursuit of Happyness,” which is based on a real story, Gardner and his young son encounter several challenges that will challenge Job himself. They have been evicted from their house, forced to remain in transit station toilets and homeless shelters, and at one point, they have just $22 in their name.

I say it doesn’t deter Gardner. He goes to work, finally wins a position at an investment company, and continues to set up his brokerage, which eventually makes him millions. We were all down on our luck at one point or another, and we could take a lesson from Gardner, who never gave up, kept working hard and searching for a chance, and eventually finding success.

Note, life is not promised to everyone. It was won in the chase.

3. The Big Short (2015)

Based on Michael Lewis’ nonfiction book The Great Short: Inside the Doomsday System, this film follows a few smart traders as they become aware—before everyone else—of the housing bubble that sparked the financial crash of 2007-2008.

The film is known for its innovative approach to breaking down complex financial instruments by, for example, letting Selena Gomez explain what synthetic CDOs are at a poker table, or Margot Robbie explain mortgage-backed bonds in a champagne bathtub.

Though millions of Americans tend to forget about the 2008 financial crash, movies like The Big Short” help illustrate how the mortgage bubble burst and the consequences resulted, pointing at the corruption of greedy lenders.

4. The Wolf of Wall Street (2013)

If you haven’t seen this Scorsese biopic chronicle the rise and fall of the famous stock scammer, Jordan Belfort, then you’re losing out on some of the best performances of Leonardo DiCaprio and Jonah Hill’s career.

The Wolf of Wall Street is based on real-life incidents (though again with a massive number of dramatic events), including the notorious Stratton Oakmont, an over-the-counter trading company pump-and-dump scam that helped IPO many large public corporations in the late 1980s and 1990s.

Do you know the adrenaline rush makes you feel while riding a roller coaster? “The Wolf of Wall Street,” a high-octane thriller, is sure to get you on the edge of your seat while you watch the story of Jordan Belfort, an investment banker on Wall Street who tricks his way from the working class to a mansion and a yacht while controlling the stock market. His ego finally got better of him, leading to financial ruin and prison time.

While this film portrays the excess spending and luxurious lifestyle of investment bankers, the underlying message reveals a rich man who leads an empty life and how wealth doesn’t buy him the satisfaction he hoped it would. There are a lot of financial lessons to be learned from this exciting show.

5. Wall Street (1987)

Is greed a healthy thing? According to Gordon Gekko, that’s it. Michael Douglas’ portrait of the Manhattan businessman won him an Oscar in 1987. It also brought pop culture a famous money guy to reflect the corruption that the capitalist system can create and the threats to the economy that it can cause.

The number one finance film that any professional must-see is the Oliver Stone classic that has offered thousands of college graduates the immortal expression “Blue Horseshoe loves Anacott Steel” as they hurried to their Series 7 exams. Originally intended to illustrate the greed and hedonism of banking, Wall Street still wields tremendous influence as a recruitment mechanism for traders, brokers, analysts, and bankers almost 30 years since it was made.

“Wall Street” is a classic tale about the rise and fall of an inexperienced young worker desperate for success at all costs but does not realize his pitfalls. By the end of the film, Bud Fox learns a valuable lesson: playing by the rules and living a life of integrity and fidelity are more important than all the cash in the world.

While the film seeks to warn us of the risks of insider trading, let’s face it who wouldn’t want to be Bud Fox or Gordon Gekko (legitimately, of course) and indulge in our greedy side; after all, as Gekko would say, “Greed is good.”

6. Glengarry Glen Ross (1992)

There are men everywhere. In David Mamet’s “Glengarry Glen Ross,” bottom-up real estate salesmen waste their time persuading people to purchase property in Florida for a lot more than it’s worth. It’s a similar theme to “Wall Street”—do what you’ve got to do to get rich—with one significant difference: these guys aren’t effective.

An acclaimed grand-screen adaptation of a play by David Mamet, this infinitely conspicuous film centres on a team of downtrodden real estate salesmen whose values have been undermined after years of working for their unscrupulous business. This film illustrates the corruption and underhanded practices that sales positions can be subjected to, as well as the strain placed on salespeople by their bosses.

Although the whole cast is top-notch, Alec Baldwin’s “motivational speech” steals the entire film and shines a light on the very best and worst faces of working under immense strain.

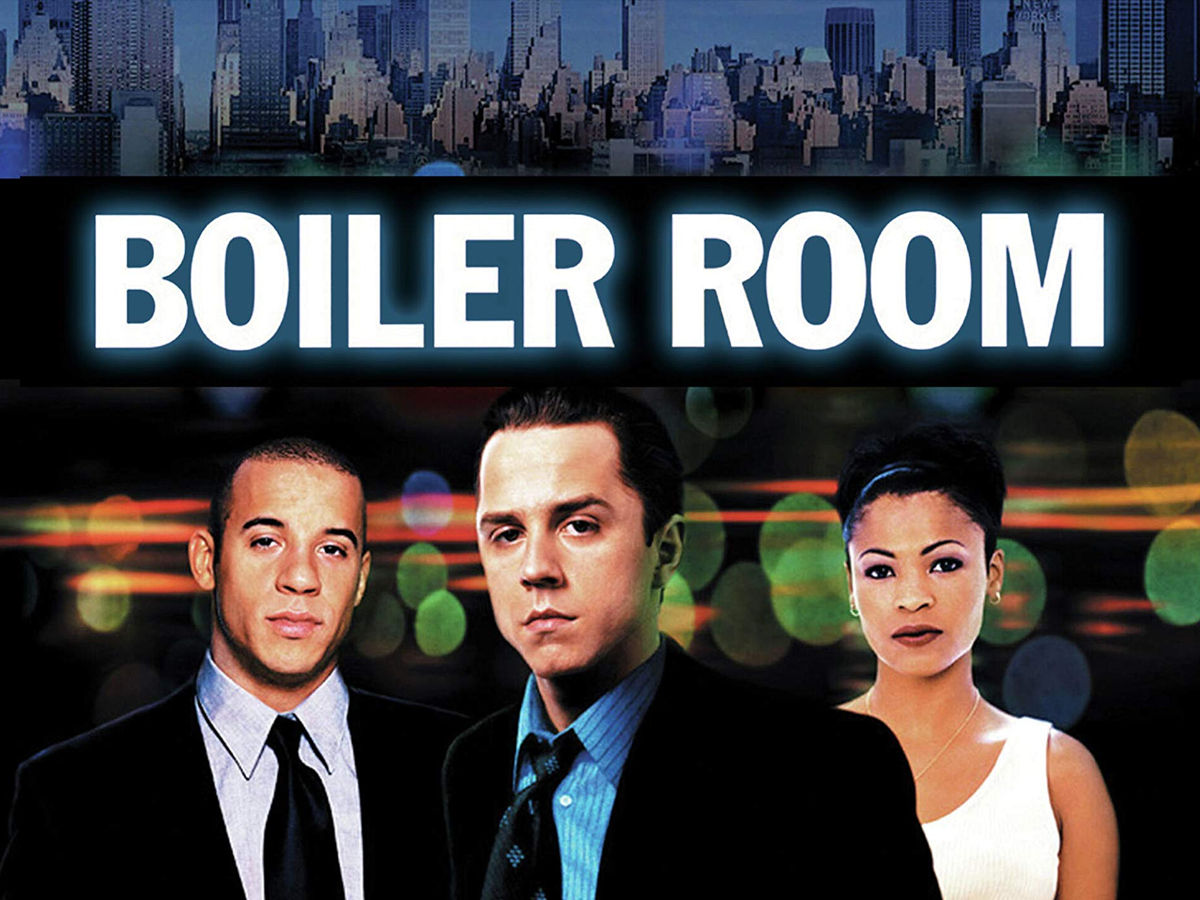

7. Boiler Room (2000)

“Boiler Room” is sort of like “Wall Street” and “Glengarry Glen Ross” had a son. It’s about stockbrokers who use high-pressure advertising tactics to get consumers to purchase – or need – financial goods they don’t like.

The Boiler Room is set at the very lowest financial ladder step: the pump and dump system. Although the Boiler Room is a fictitious job, pump-and-dump businesses are genuine, as are the misery and suffering they inflict on their victims.

The Boiler Room acts as a tip to those who are beginning to invest in the stock market, to stick to clear, reliable businesses focused on sound economics, and to still follow the saying: “If it sounds too good to be true, it probably does.”

What did we learn?

These films are a must-see for any aspiring financial pro, but even if you’re not dreaming about a future in the industry, these films will offer a little insight into the crazy and often ridiculous world of finance. However, as the adage goes, “Truth is stranger than fiction,” and as incidents such as the 2008 recession, the collapse of Enron, and the Madoff affair have proven, real-life can be much more incredible than any Hollywood script.

When the credits have been rolled, hard work starts. Adapt to your situation the things you’ve experienced. If you want to discover yourself out of debt, begin by making a personal budget and cutting off all wasteful expenditures.